By rail across the Spanish-French border. Do difficulties in network access prevent more traffic?

RailLive 2025-11-28 presentation

Hello

- Studied at the Bilbao Engineering School, and worked for the rail industry for almost 10 years, on Automatic Train Supervision for urban railways.

- Move on, out of the railway industry, but coming here as part of my voluntary work in pro-rail organisations.

- The Associació per a la Promoció del Transport Públic (PTP), which is a member of the European Passenger Federation (EPF)

- And the Back-on-Track network for the promotion of night trains and cross-border services.

- I hope to be able to contribute to the overall understanding of international rail from outside of the industry. I'm here for learning as well, and sharing my findings as a railway activist. I hope this talk helps connecting with new colleagues and together we can add more pieces to our common understanding of this jigsaw puzzle.

The French-Spanish rail border

We'll introduce the geography and demographics of the border, and add a little of historical context to how we got to the current rail network.

The natural barrier

- The Pyrenees mountain range forms a 500km natural barrier with just four usable rail crossing points.

- This barrier generates two chokepoints near the sea, two spots where all lines need to converge. This represents also an opportunity for connecting services to different destinations.

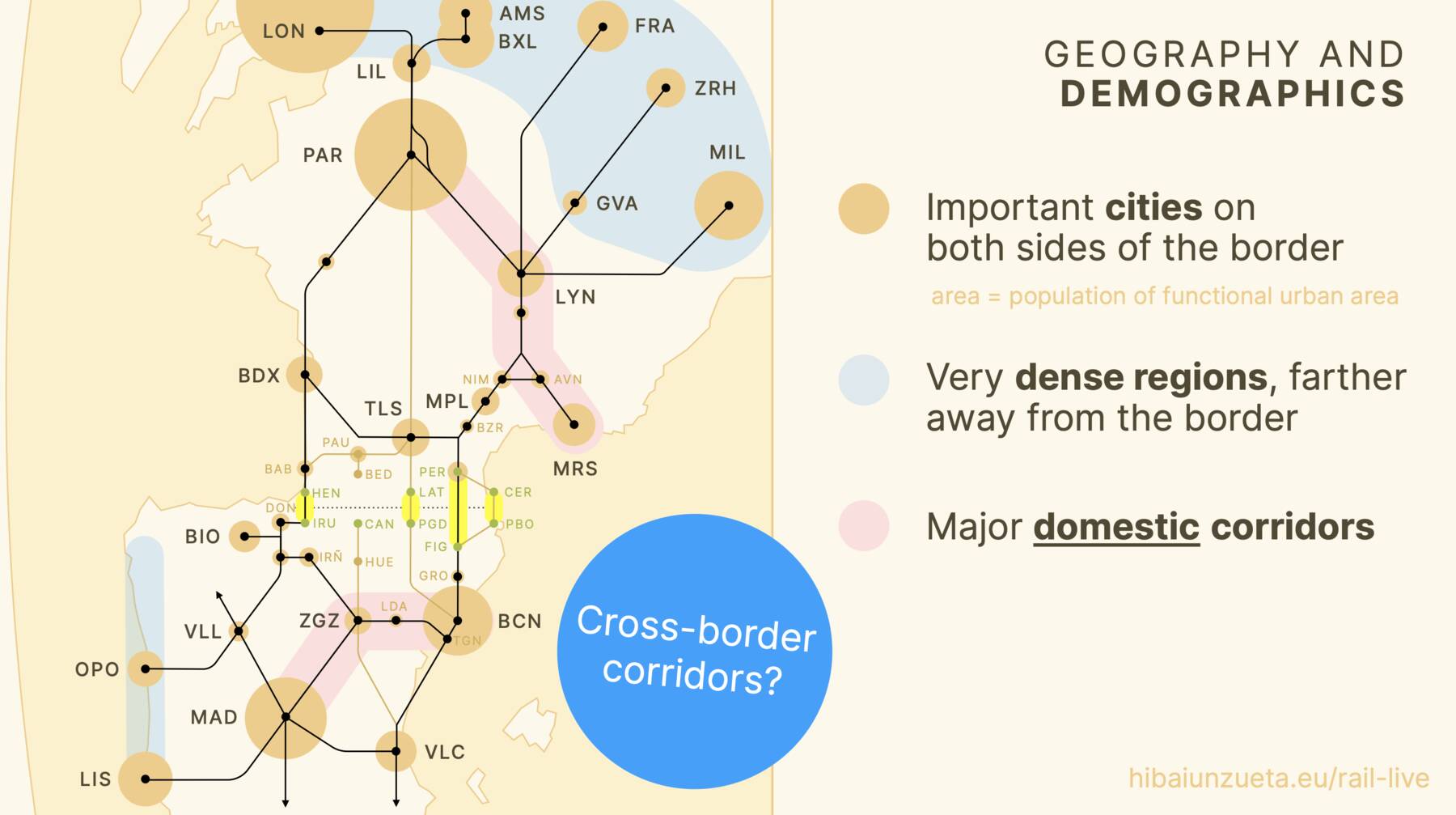

Geography and demographics

- Here's a map of the larger area with rail links on the 2030 horizon.

- We can notice important cities on both sides of the border. The area of the circles represents the population of their functional urban areas (FUA).

- We also notice farther away very densely, continuously populated areas, such as what is known as the blue banana at the north or the Galician-Portuguese coast. The distance to the border is bigger but there's an important concentrated demand there.

- Let's also look at major domestic corridors... which makes us think, by comparing the populations covered by these domestic corridors, that important cross-border corridors would naturally emerge if it were not for the effect of the border.

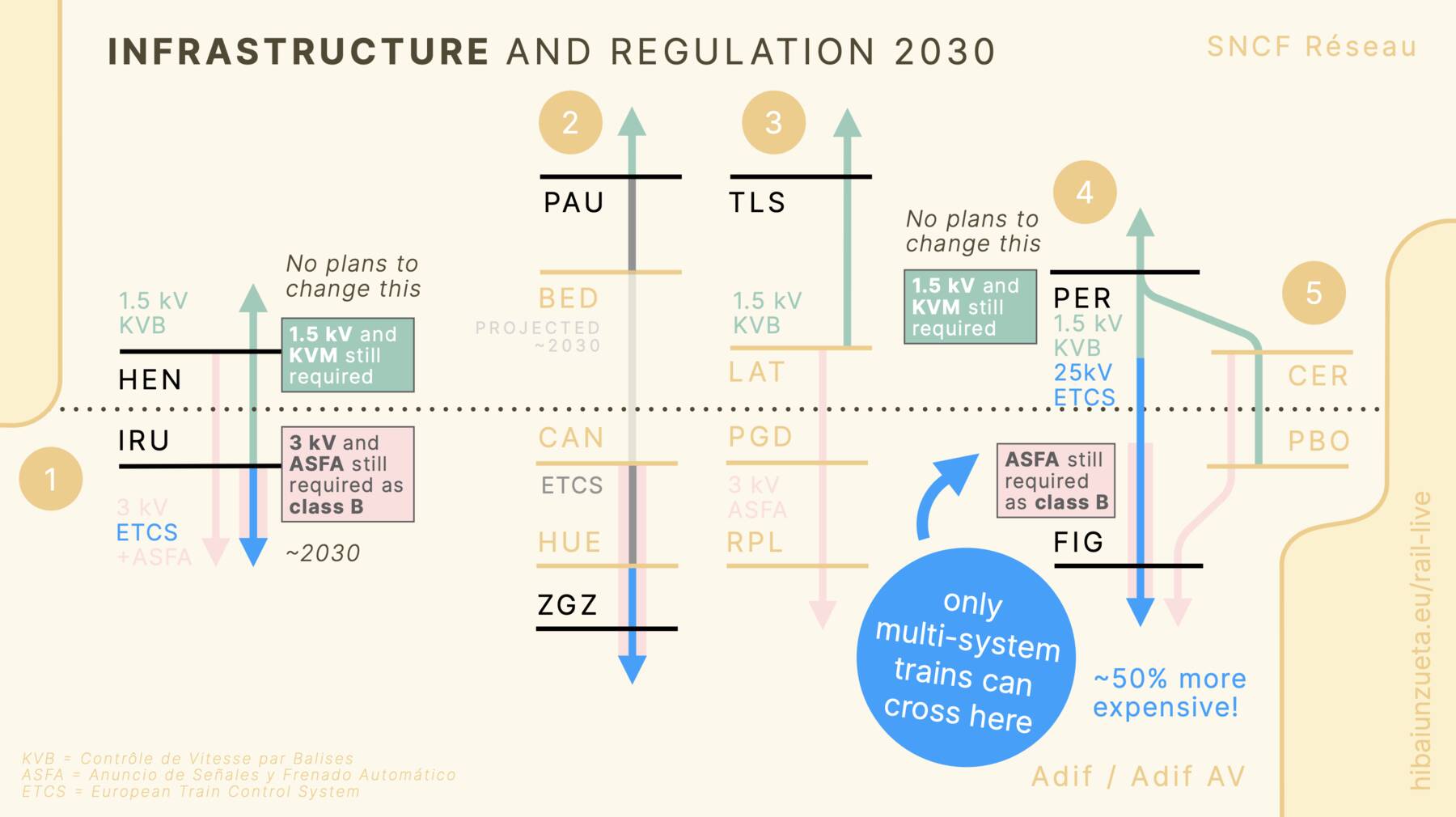

Infrastructure and regulation

- Now we'll analyse the situation of each crossing.

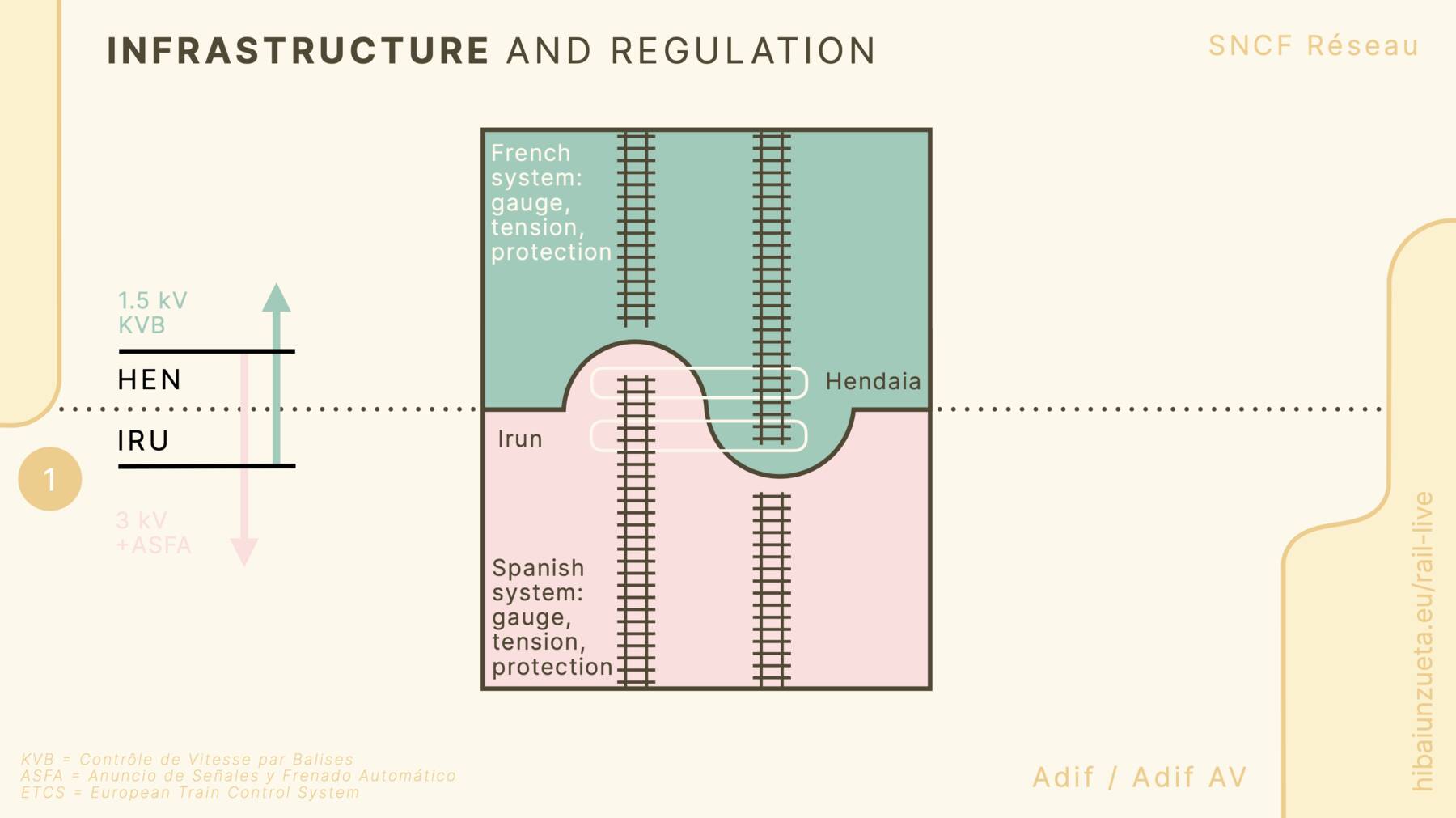

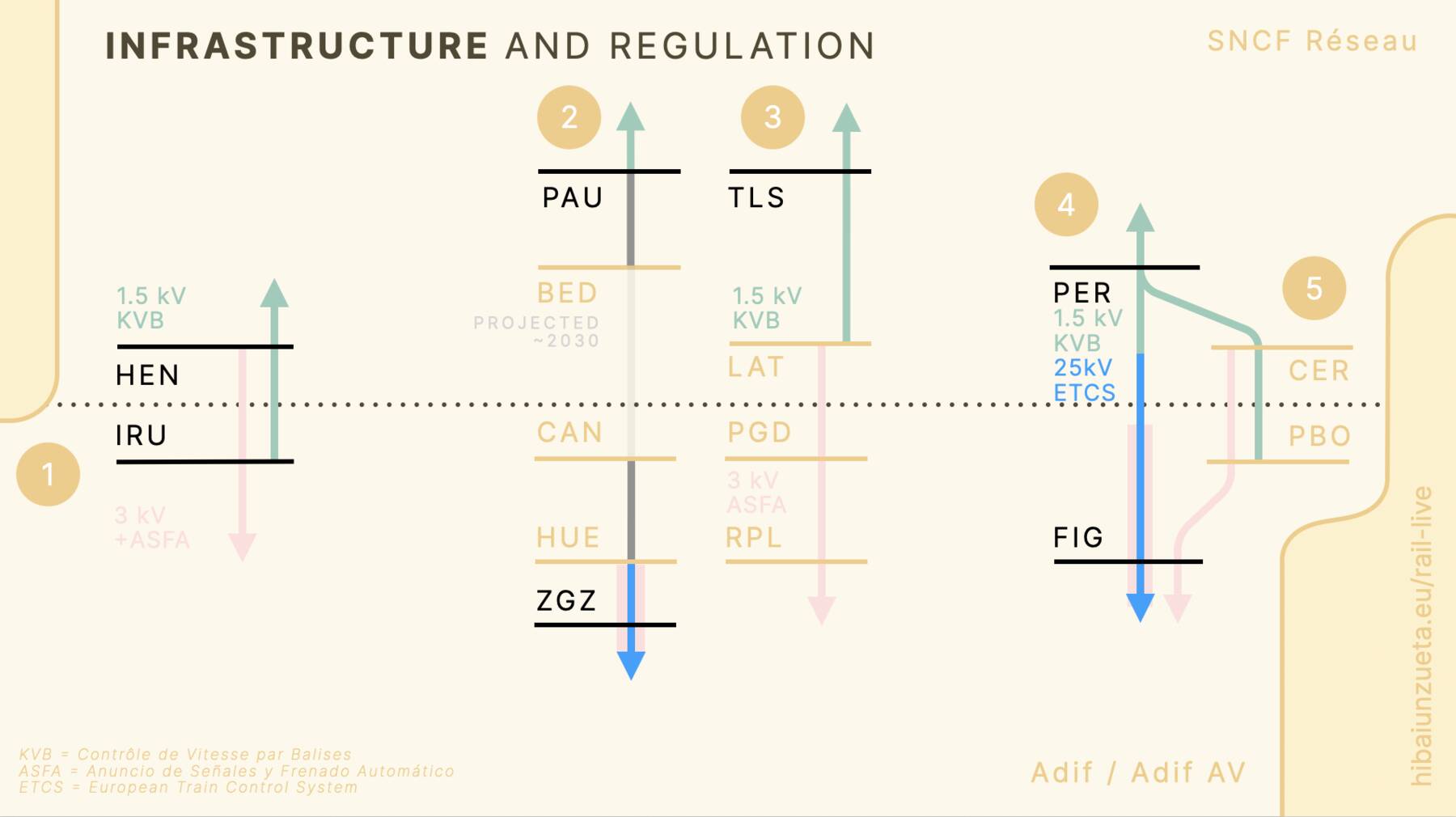

- (1) Hendaia / Irun is an example of a classic border, where the infrastructure (gauge, tension...) from the Spanish system extends a bit north to Hendaia, and the French system extends likewise south, allowing for connections at both stations.

- The conventional voltage at the South of France is 1.5kV CC, with KVB train protection. On Spain, the conventional voltage is 3 kV CC, with ASFA train protection. We'll see these systems in play in most crossings.

-

(2) The Canfranc crossing potentially linking Pau and Huesca/Zaragoza is not practicable today, but there are plans to reopen it.

-

(3) The La Tour de Carol / Puigcerdà crossing is active, following a similar structure as Hendaia/Irun but an abandoned standard gauge section between border stations makes connections only possible at La Tour de Carol.

-

(4) The newest crossing (opened 2010) has modern infrastructure: 25 kV AC and ETCS train protection.

-

(5) Finally, the Cervera / Portbou crossing is similar to the one we find at Hendaia / Irun.

-

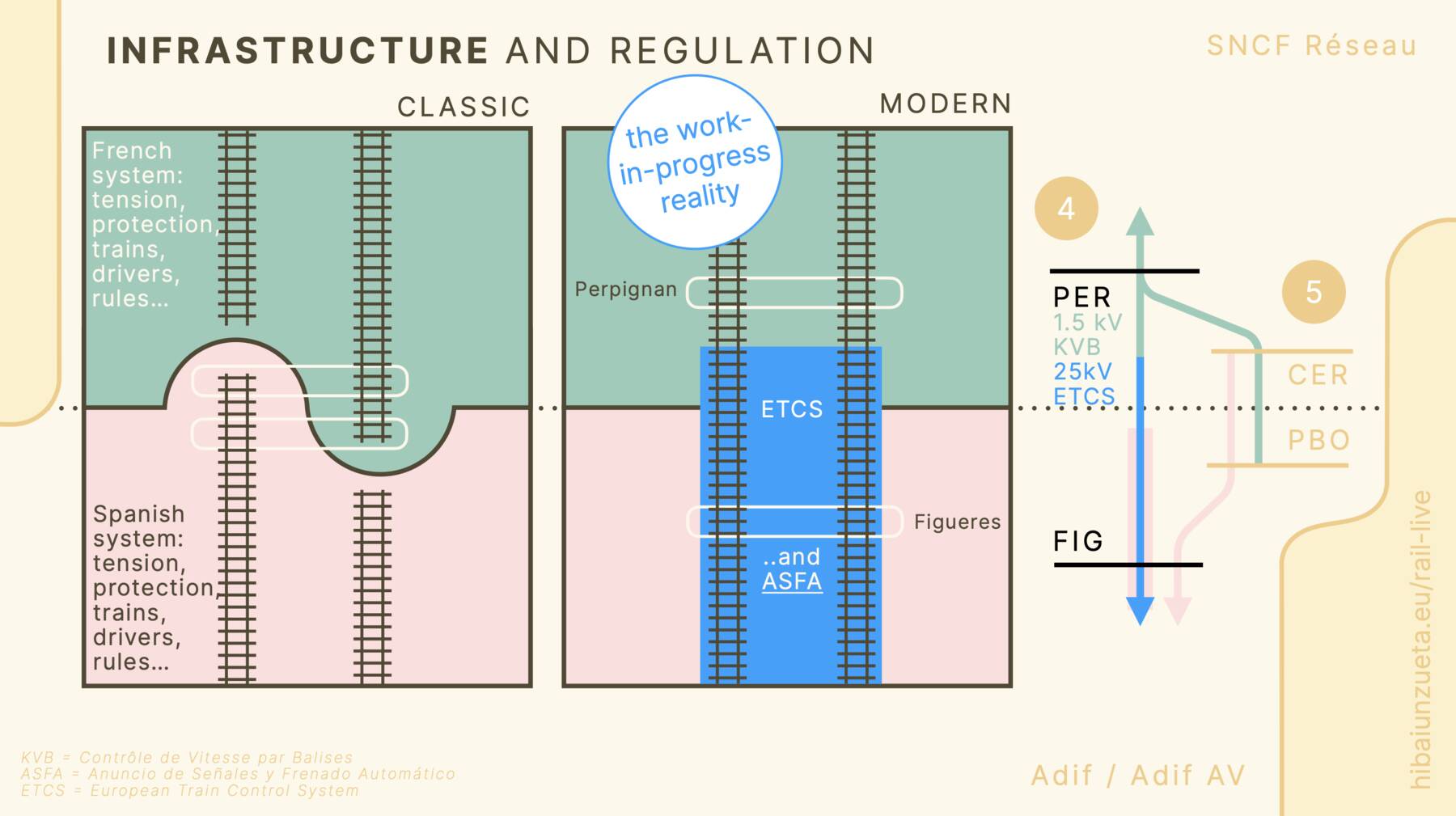

It's interesting to compare the newest rail border with a classic one. The plan is that standardised European voltage and train protection are installed for seamless cross-border services through interoperable tech.

- But in practice, given that many of the domestic services at Perpignan would not work under the new system, the station was left at the old system. Additionally, Spanish high speed rail sections still require ASFA as a class B system.

-

Let's add the short term infrastructural plans to the diagram, notably reaching the Hendaia/Irun and Canfranc crossings with standard gauge and ETCS.

-

Observe how, even with these works completed we face major barriers:

-

At the Hendaia / Irun crossing, even if the gauge issue is fixed, domestic French trains trying to connect at the border would still need to be tri-tension and support ASFA as class B to reach Donostia / San Sebastian.

-

At the Perpignan-Figueres crossing, functional today, the situation is similar. 3kV is NOT required, but ASFA is needed as class B.

-

Going north at this crossing we face a more complicated situation: Spanish domestic trains cannot connect today at Perpignan with the French domestic services because they would need to be tri-tension for the 1.5 kV tension, and support the conventional French protection system.

-

Conclusion: only multi-system trains can cross here, and most of the current domestic fleets are still bi-tension at most, multi-system trains being, as in the TGV-M case, up to 50% more expensive.

-

But cross-border traffic also faces additional regulatory barriers:

-

In order to harmonise train driver certification, the EU issued directive 2007/59/EC, which included the requirement for drivers to have a B1 language certificate. In 2016, this was amended to allow continuing to "a station close to the border if authorised by an infrastructure manager" at the receiving end. SNCF Réseau decided NOT to apply the exemption directly, but to offer a waiver ONLY IF the operator (1) has a safety certificate for operating in France, and (2) justifies additional measures to compensate for the lack of skills (source), which keeps the barriers up.

-

Also homologation issues have been reported for trains reaching Irun from France, even if some of these trains used to run to the nearest foreign station without issues in the past. Under the current regulatory framework, there are EU legislation exceptions that can be applied ("the national safety authority (NSA) may, under its own responsibility and when the applicant so requests, (...) for vehicles travelling to stations in neighbouring Member States with similar network characteristics, when those stations are close to the border" Article 21(8) of EU Directive 2016/797). But this is not working in practice.

-

Freight operations and proximity services are paying this additional burden today.

-

Other services, such as long distance trains, did not find ways to circumvent the new obstacles, bringing an end to the old practice of letting foreign trains arrive at the first connecting station.

-

Requiring domestic operations fulfill the foreign country rules just to connect at the border is like asking the mountain to come to Muhammad. But it's Muhammad who needs to go to the mountain. It's border stations, and their staff that needs to speak the language on the other side, and provide tiny stretches of rail into the first platform at their country.

-

Otherwise, this is just an added cost to services that reach the border which are already challenging to run profitably.

-

Conclusion: National Safety Authorities (RS homologation) and Infrastructure Managers (driver language requirements) are blocking the normal reciprocal functioning of traditional borders with no technical barriers, and they are yet to make a move to make domestic network interconnection a no-brainer for operators. This is a small move in the overall system with benefits for both sides.

Notes:

- The RER Basco-Landais is expected to reach Irun by 2026. It'll have to face the problems exposed, incur in higher costs (as Occitanie and Rodalies de Catalunya are doing at Cerbère-Portbou) unless red tape is removed by the mentioned players.

- For context, this map shows the ETCS deployment calendar in France

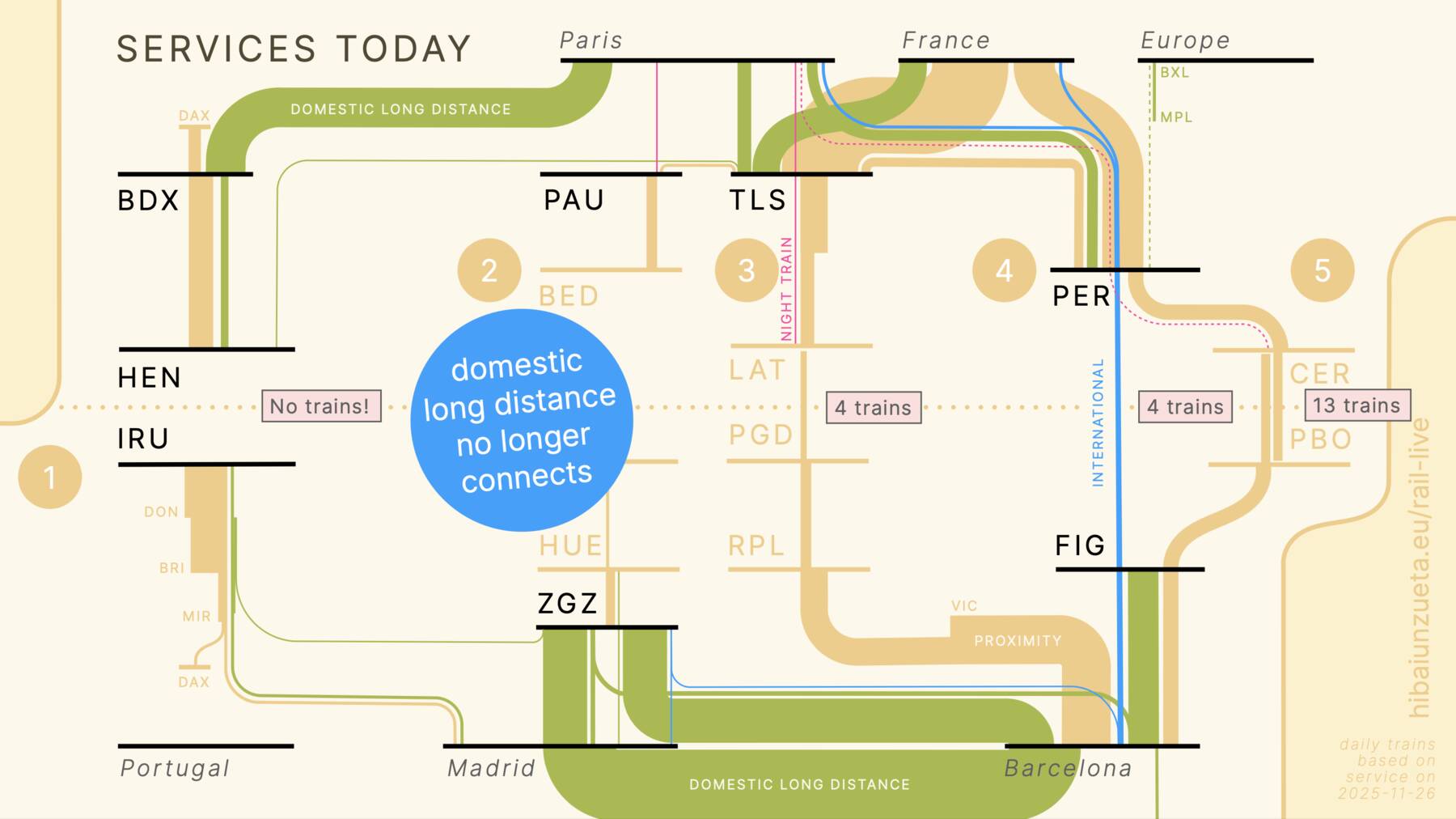

Services today

- Here are the rail services that run near the border area. The thickness is relative to the number of trains per day. In ochre colour we see proximity services (which become thiner and thiner at the border), long distance services in green, international trains in blue and night trains in pink.

- Two striking facts we can see here:

- (1) One is that there's no service at all between Hendaia and Irun, despite existing infrastructure, and despite the area being continuously populated and with clear cultural ties. This is due to the additional regulatory barries we've just mentioned.

- It's also important to notice, that the proximity service lines get thiner and thiner on the few existing connections. This makes it hard for regions near the borders to use trains for trips to major cross-border areas within the day.

- (2) Another striking aspect is, as we already brought up at the demographics slide, considering that there's important populations cross-border, why do we see a 4-trains thin blue line, whereas we see a very thick green line?

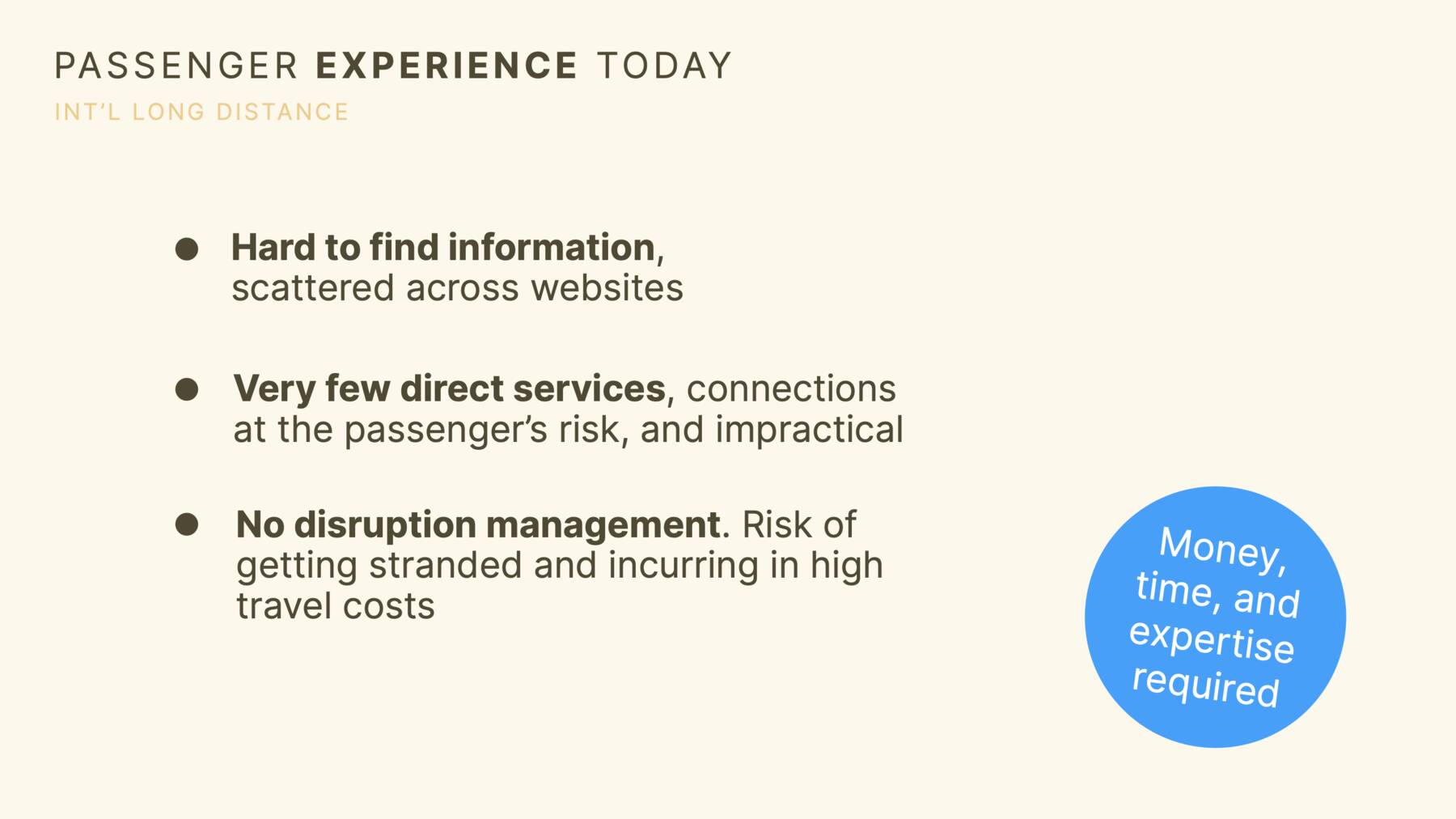

Passenger experience today

- For many people who want to use trains to go across the border their experience will be complicated to say the least.

- Information will be hard to find, often scattered across operators or aggregators websites, including expert advice from Websites like Seat 61, or timetable information resources like ÖBB Scotty.

- The lack of domestic connections and the very few international direct services make it hard to find suitable trains. Connections are often impractical, and they may even require lay-overs.

- The price is often very high compared to alternatives.

- The moment you need to combine trains, which is the case for most destinations and times, this is done at the passenger's risk. In case of delay, a different operator may not take you to your destination on the next train, which means that you can incur in expensive additional travel costs.

- Some operators are participating on the voluntary Agreement on Journey Continuation (AJC), which is set to patch some of the problems. But most passengers are not aware of this agreement, which is not surprising because it does not even show on some of the operators Websites. And the process of getting accepted on a following train is cumbersome, putting the burden of getting evidence of the delay on the passenger. Additionally, the agreement breaks on connections with very few trains, which is the case for Spanish-French cross border travels.

- Consequence: Money, time, and expertise are required to use long distance international travel across the Spanish-French border on a normal basis.

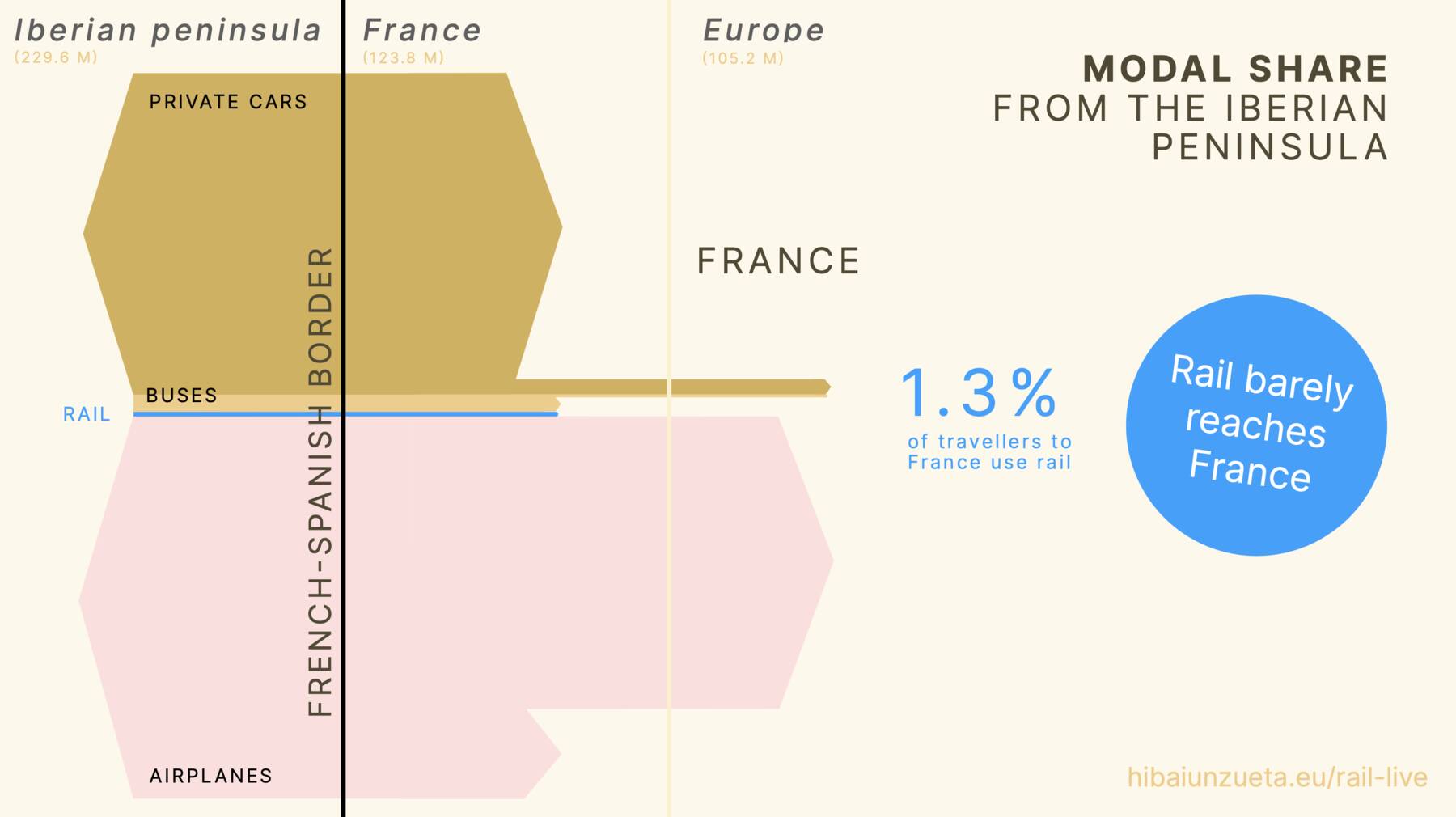

Cross-border rail modal share today (5)

-

Is not that striking to see that for Iberian travellers, crossing the border to France with rail is marginal. In traveller numbers, Rail barely reaches France.

-

It's not a matter of choice, but a lack of services. Travellers don't even get to choose.

-

But we saw the demographics, we saw the corridors, we remember there were connections at the borders and direct services in the past. So... why is international rail not thriving now?

European Railways: A system in transition

Let's now try to see how rail was organised in the past and what's changing now.

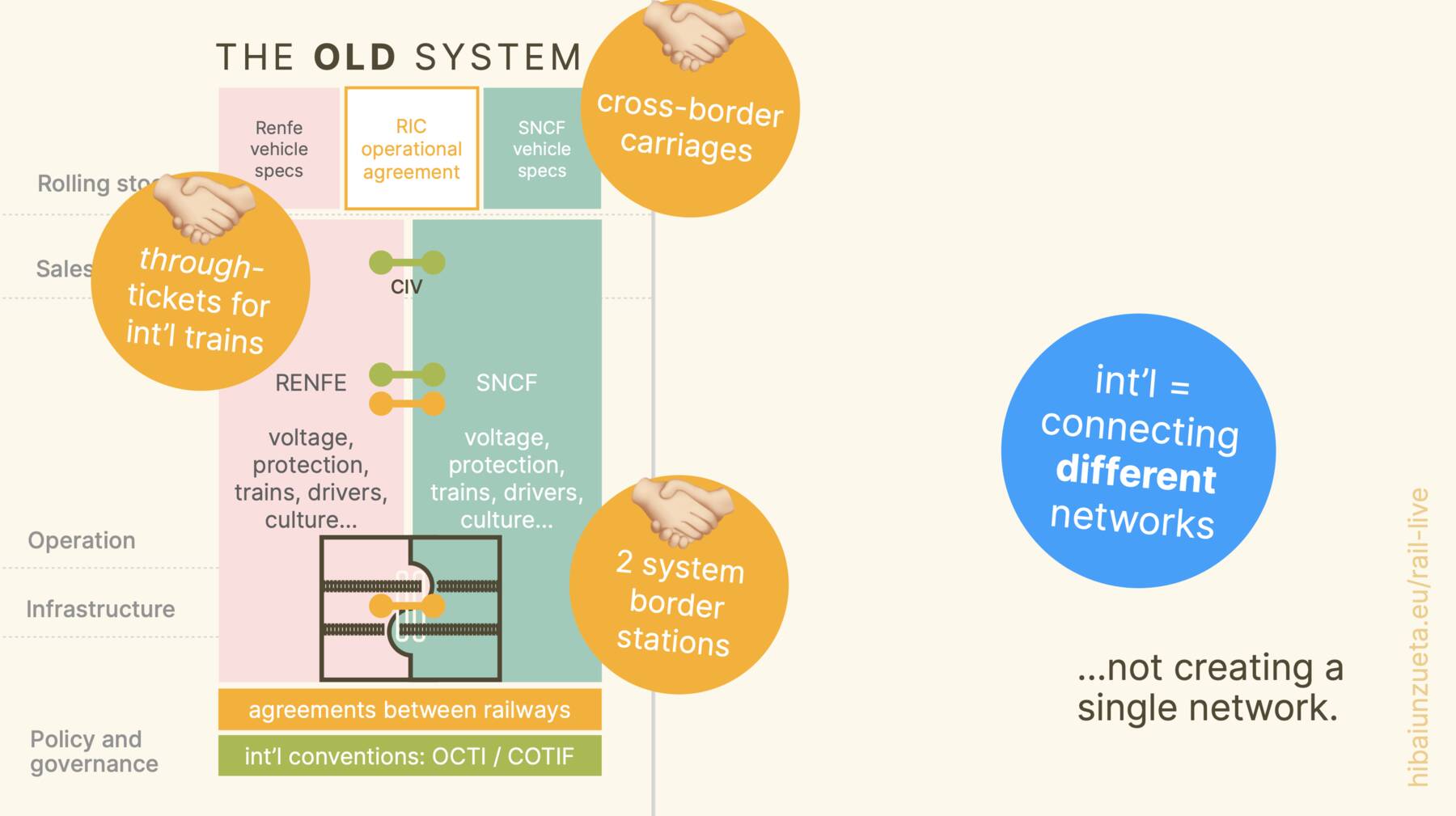

The old system

Let's have a look first to how the system worked in the past (excluding freight in the analysis for the sake of simplicity).

- By that time, states, with full control over their railways, had agreed to connect their networks at the borders. States engaged in bilateral or multi-lateral agreements to create the legal framework for handling passengers and selling tickets, even to international destinations. CIV was born.

- How did international rail happen? Simple, by connecting national services at agreed times at border stations. Passengers walked from one train to the other, often with a through ticket.

- The companies were vertically integrated, they redacted their own rolling stock specs, they sold tickets, they ran the trains, and they built the necessary tracks. By agreeing between themselves (see orange color here), they created the RIC standard, which allowed coaches from different companies to travel around Europe.

- In the case of the Spanish-French border, that meant changing axles, but regulation-wise, the carriages were accepted by the receiving railway, which would couple them with their own locomotive.

- Driver and conductors were also changed. Each railway had their own territory, their own rules, but passengers could still flow, even without changing trains by accepting each other's coaches at the border, exactly the same way as you would take the baton from another runner in a relay race.

- This basically means that, except for the axle change operation, the economics of international trains were not significantly different to domestic ones.

- Interconnecting the networks, even engaging in cooperative international services like Elipsos was a no-brainer, since it brought new passengers, and neither could challenge the other's home market.

- International was just connecting different networks, not creating a single network or area.

- The price to pay? Some report obscure accounting, and the resulting challenge for cost control, leading to not so efficient management.

- Even before the arrival of EU legislation, this view took a certain weight, and the railways started to better separate the areas of activity. For example, Renfe separated their Servicios Comerciales (SSCC) from Servicio Público (SP).

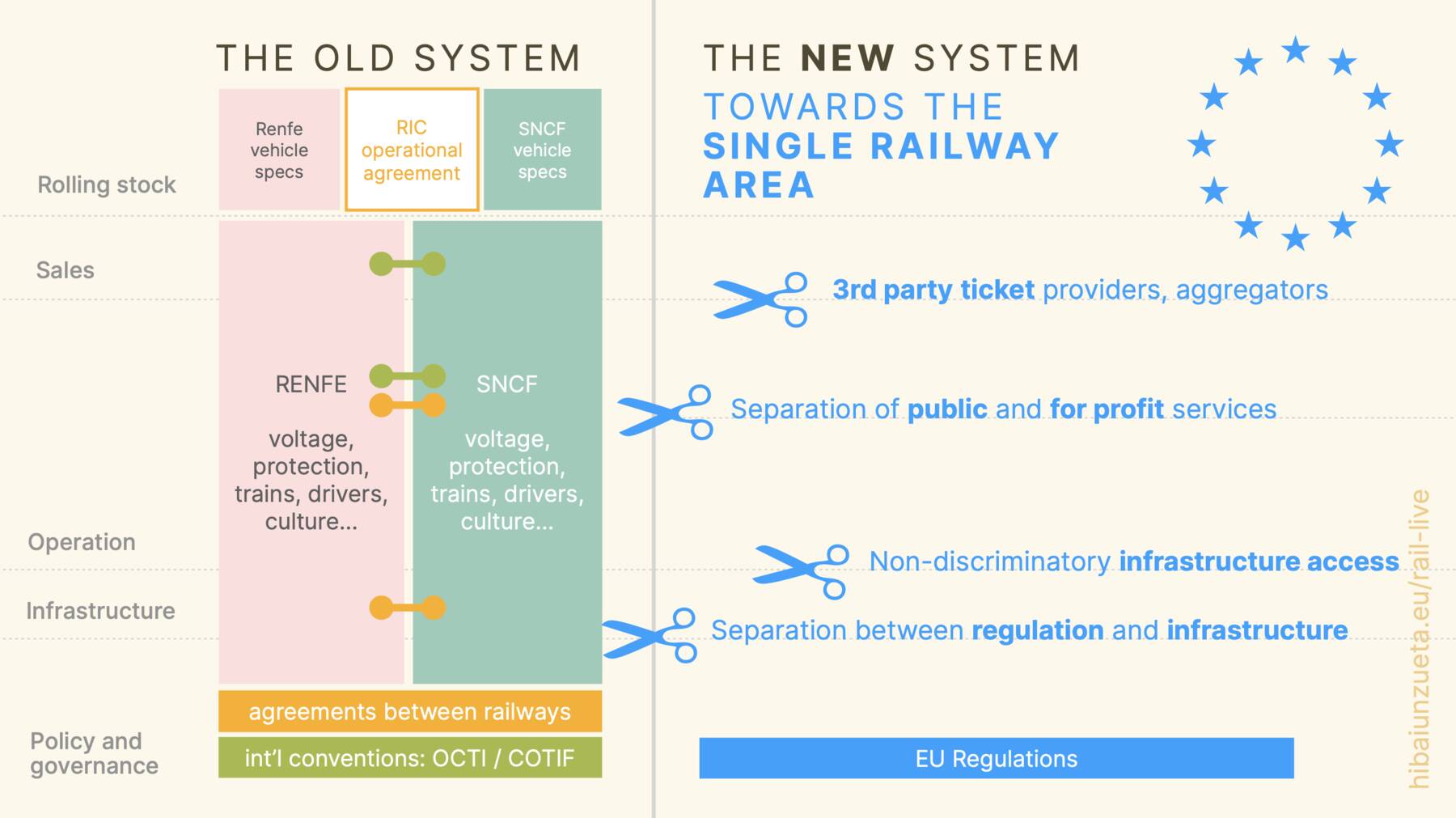

The new system

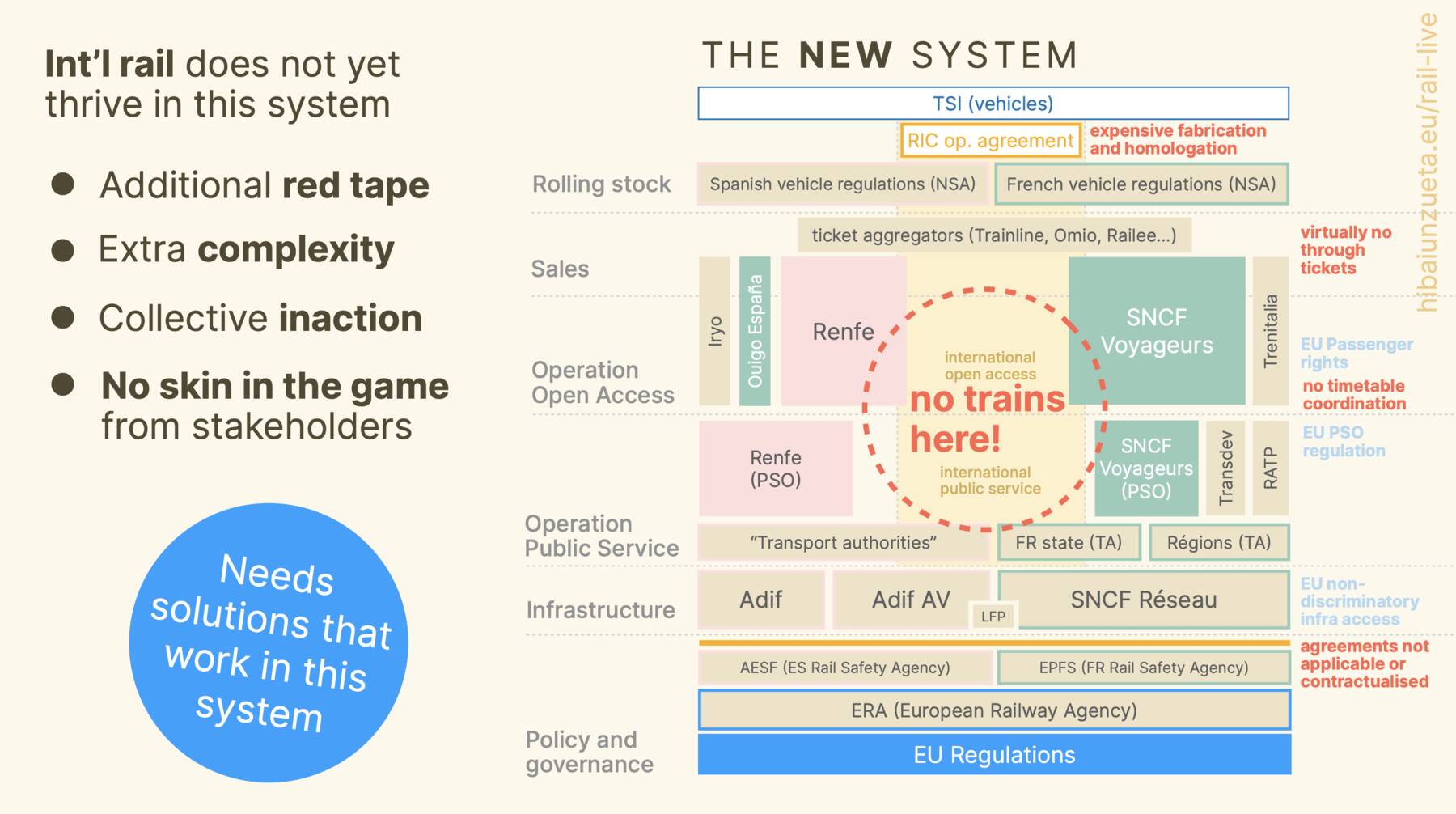

- But the successive Railway Packages of the EU introduced a new system.

- On this new system, infrastructure had to be separate from operation, allowing other operators to enter the domestic market, which was intended to produce more and better services through competition.

- Also, the funding of unprofitable services was regulated, together with an end directly subsidising national operators without control of where the money was used.

- New players and regulators were introduced to prevent historical railways from being at advantage.

- Now we have a picture with more individual players.

- This new possibility of entering foreign markets, was picked up not by new private companies but mostly by major historical players with better access to rolling stock. The intention is to do well internationally, and over time turn these operations into a major revenue source.

- Important note here. The cost of trains, the fact that Europe does not have a mature rolling stock leasing market plus the fragmentation of regulations mean that, major railways, backed by their respective states, are the only ones that can normally afford buying trains, and private initiatives mostly get stuck trying to access initial funding.

- Currently, this has led to SNCF and Renfe becoming direct competitors on each other's most profitable domestic routes. SNCF's low-cost Ouigo service is aggressively expanding within Spain, while Renfe is fighting to launch its own services to major French cities like Paris and Lyon.

- The transition from the international conventions, and industry agreements of the past to the new EU regulatory framework is also leaving some gaps, which are impacting international services.

- For example, rolling stock specifications are now turned into regulations, and railways are not the active players. To keep up with technological, safety, and infrastructural changes (new tunnels, etc...), National Safety Authorities create new rules from the point of view of their member state alone. Although ERA is busy trying to harmonise requirements through TSIs, past agreements, such as the RIC, are turned into a baseline. Today, to run RIC coaches you also need to certify them with national safety authorities, in each of the countries your train runs, which defeats the purpose of RIC coaches in the first place.

- The separation between public service and open access (for profit) operations creates some dissonance for the operators. On the one side, they are still public companies, on the other side they cannot receive money from their governments unless very specific Public Service Obligation (PSO) conditions are met.

- One of the consequences is that they will be more keen on cutting services that connect with a foreign operator at the border if they don't see it bringing significant profit.

- Additionally, the fact that the historical operator is facing fierce competition from its neighbour and the associated reduction of margins on profitable routes does not leave much space to pay attention to connecting at the border, but rather reducing spending as much as possible on areas (like cross-border cooperation) that are not competition on the key, modern, and high-demand domestic routes.

- To cut a long story short: If your core existence is challenged, you don't waste your effort at expanding a more challenging business area (both in terms of lower demand, and higher cost and complexity).

- Yet, collectively, together, as a whole, rail, engaged in this zero-sum game, is missing the international rail market.

- International rail, today has negligible numbers compared to the domestic market. This is not only fully explained by the demographics or even by infrastructure.

- We must be collectively make an effort to improve this system and balance its dynamics so that international rail, at the core of the union's objectives, is not its victim.

- Responsibility gaps and ambiguities must be addressed and resolved.

- Policymakers and the industry need to get involved in fixing the areas where this system breaks, removing unnecessary red tape where possible, and also rebuilding the pragmatic alliances to move forward. What can each of the players do for rail to capture a major part of the cross-border travel?

How to get more cross-border trains

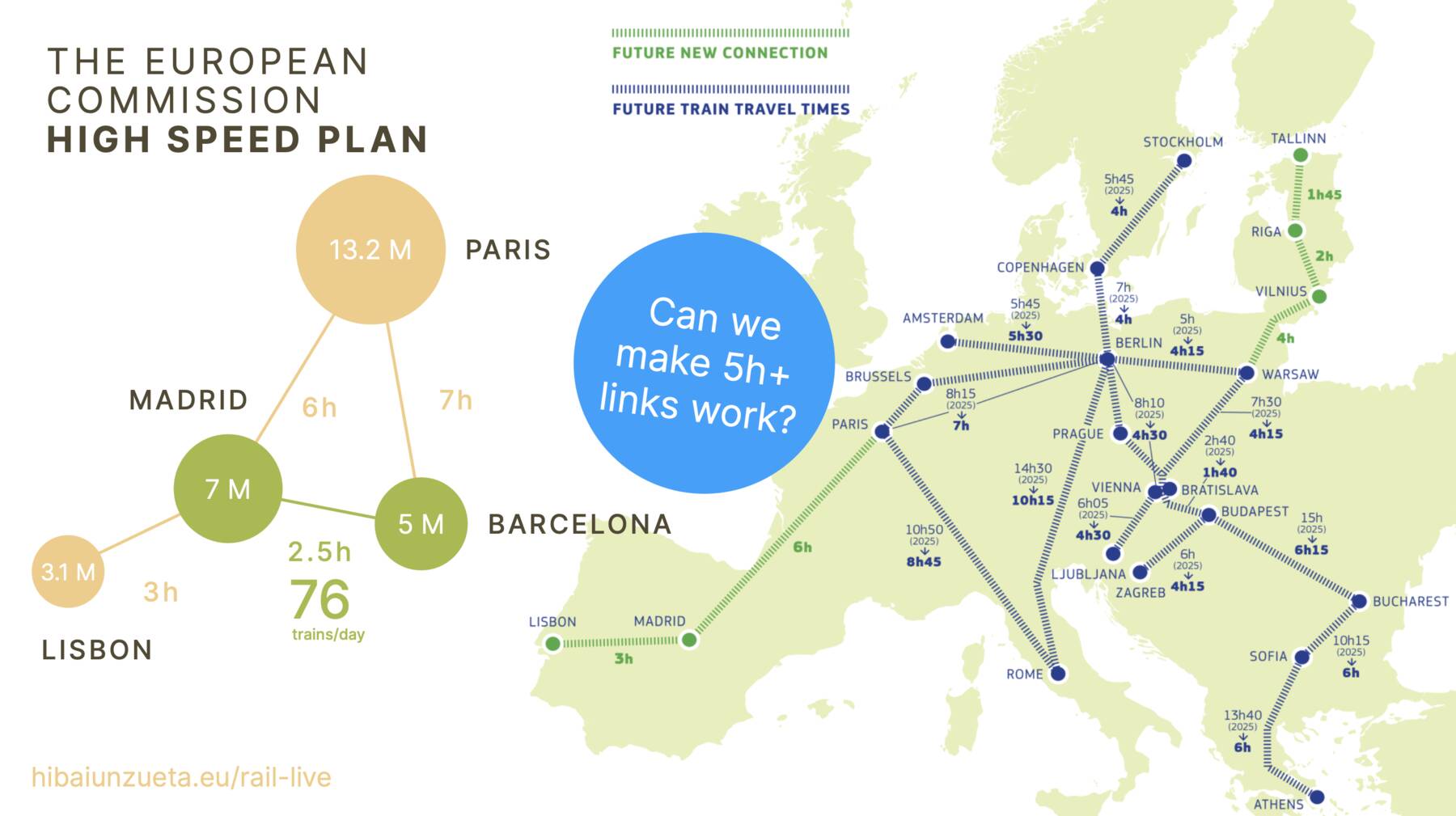

The European Commission High Speed plan

- The EU focuses on funding infrastructure to close the gaps.

- The rationale is: With faster links, operators will find profitable ways to fill the gaps in the network.

- But notice the blind spot: Many of these core connections are 5h+ long, incurring in high costs, because of how TACs are structured, and because of the technology and regulation fragmentation.

- Looking at the Madrid-Paris-Barcelona triangle, we see that even today, at 7h Paris-Barcelona does not produce a good enough level of service.

- So, while investing in cross-border infrastructure is important, it's not sufficient.

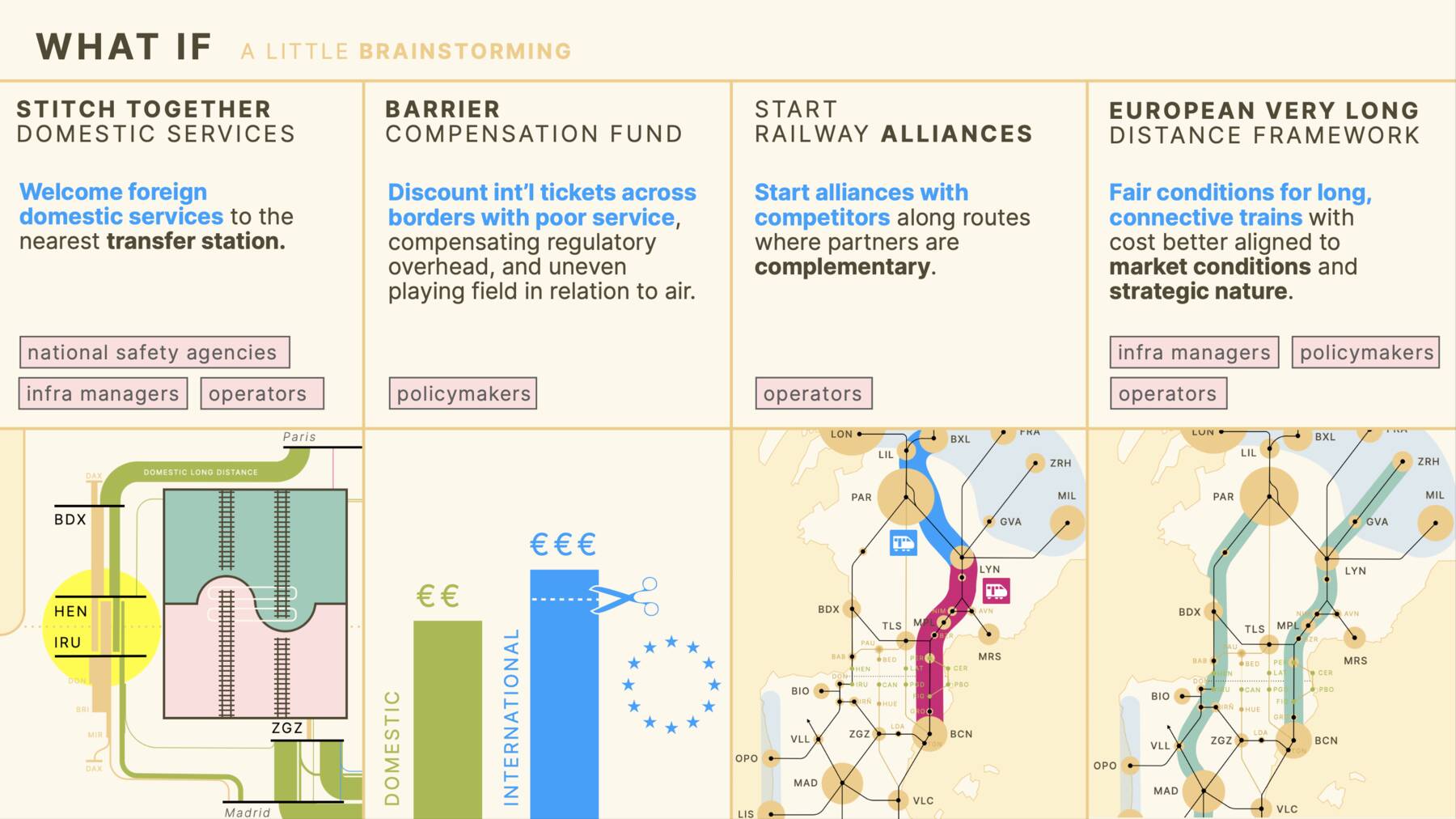

What if. A little brainstorming

I don't claim to have easy solutions. But the system is big and has many intervention points. Let's quickly explore some and hopefully leave you with some of these ideas on the back of your mind.

What if: Stitch together domestic services, connect at the border

- Railways sometimes say that their focus is domestic rail because that's where over 90% of their customers are. True.

- What if, then if they go the extra mile of connecting their domestic traffic at the border?

- This is a pragmatic solution to allow international travellers without disrupting too much the domestic operation.

- Infrastructure managers (p1) and national safety agencies (p2) should feel responsible for the bare minimum of receiving foreign trains at the first border station. This can be incentivised by treating the few metres to the border station as special segments, and even reducing TACs for the line segments that connect the border stations with the main cities close to the border, where most domestic services end today.

- Reciprocity is not even required here, as any connection possibility involves trains at both sides of the border, so it's good for players on both sides.

- This baseline can help develop the cross-border rail market by enabling operators to launch international direct connections on top. By offering both direct and connecting train trips, the increased frequency can help offset the longer travel times and higher operational costs.

- What's the fear now that the competitor is already at the heart, at the core domestic markets?

- Redeveloping international rail is a win for the whole sector, on both sides of the border.

What if: Barrier compensation fund

- We've seen that in this new system, running an international service is more costly for any operator, in terms of both regulatory complexity and train costs.

- While we wait the long years till one day crossing the border is seamless, the EU could step in and promote cross border connections by directly funding international rail tickets.

- This would partially compensate for the uneven playing field, where international aviation is exempt from paying fuel taxes and operates in a consolidated international market, whereas international rail needs to operate in a more complex environment than before the EU reforms.

- The fund could be made variable depending on the maturity of the cross-border connection (measured in trains that cross it), so, as service develops and borders become more inter-operable, the compensation would reduce.

- The player here would be the European Commission to find appropriate funding for these cross-border service tickets.

What if: Railway alliances

- Airlines form alliances with competitors along routes where they are complementary.

- Can rail operators copy this model?

- Imagine going to renfe.com and booking a trip from Madrid to Lille by combining one Renfe train and one SNCF train. This is not necessarily a problem for neither operator because they don't offer that trip on their own, and it would help with the perception that international rail is possible.

- The players here would be any combination of operators willing to sell tickets in their trains as part of a longer trip, expanding their market.

What if: European long service framework

- 6h, 8h, 10+ hours... We've seen in the European Commission's high speed plan that, even with substantial infrastructure connecting Europe involves now, and will involve in the future, very long train lines.

- Current pricing by the kilometre does not play well for the economic sustainability of these services.

- Two types of services are possible: (1) day trains with stops along the route but seeking to offer competitive end-to-end prices, and (2) night trains that use the resting time to reduce the perception of travel time.

- Infrastructure managers (P1), policymakers (P2) and operators (P3) need to get together to find reasonable running conditions for these trains, taking into account that they cater to a completely different market that today cannot use rail.

Finishing thoughts: What can YOU do for cross-border trains?

- These are just a few ideas coming from someone outside of the industry.

- Policymakers and the industry need to get involved in fixing the areas where this system breaks, proposing solutions, removing barriers, and importantly building the pragmatic alliances needed to develop international rail.

- What can you, as a major player, do for more cross-border trains?

Thank you!

- I would like to thank the European Passengers' Federation (EPF) and Associació per a la Promoció del Transport Públic (PTP) for giving me the opportunity to come here to talk about international rail.

- And I'd like to acknowledge and thank as well the work of rail activist Jon Worth, whose #CrossBorderRail project is both a big motivation and a great source of information about problems and pragmatic solutions you should definitely check out.

- For any questions ideas or further discussion find me on my LinkedIn profile where I'm happy to share more contact details.